sacramento county tax rate

The current total local sales tax rate in Sacramento CA is 8750. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Some property owners in San Diego City have a.

. View the E-Prop-Tax page for more information. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

Compilation of Tax Rates by Code Area. The current total local sales tax rate in Sacramento County CA is 7750. 33 rows The local sales tax rate in Sacramento County is 025 and the maximum rate including.

The 2018 United States Supreme Court decision. This is the total of state and county sales tax rates. The California state sales tax rate is currently.

Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US. 6 rows The Sacramento County California sales tax is 775 consisting of 600 California state sales. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

View the E-Prop-Tax page for more information. Tax Rate Areas Sacramento County 2022. Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04.

What is the sales tax rate in Sacramento California. 2021-2022 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1. The December 2020 total.

This is mostly due to the general tax levy of 1. The December 2020 total local sales tax rate was also 7750. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and.

Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. 5 rows The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025. This is the total of state county and city sales tax rates.

Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. Department of finance auditor-controller division 2022-2023 equalized assessed values by tax rate areas rpt clmn 5 6 8 10 11 5 6 8 10 11. The Sacramento County sales tax rate is.

Equalized Rolls - District Valuation Report. The minimum combined 2022 sales tax rate for Sacramento California is. Sacramento County collects on average 068 of a propertys.

Sacramento County has property tax rates that are similar to most counties in California.

What Has Proposition 30 Meant For California California Budget And Policy Center

Orange County Ca Property Tax Search And Records Propertyshark

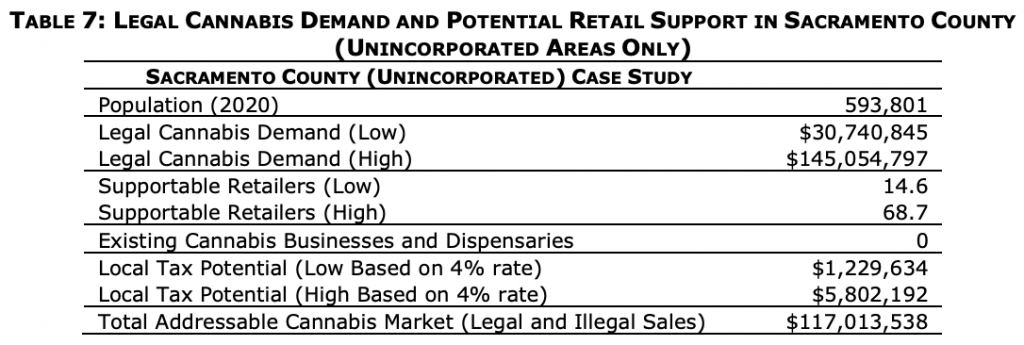

California Tax Rates Impede Legal Operators New Frontier Data

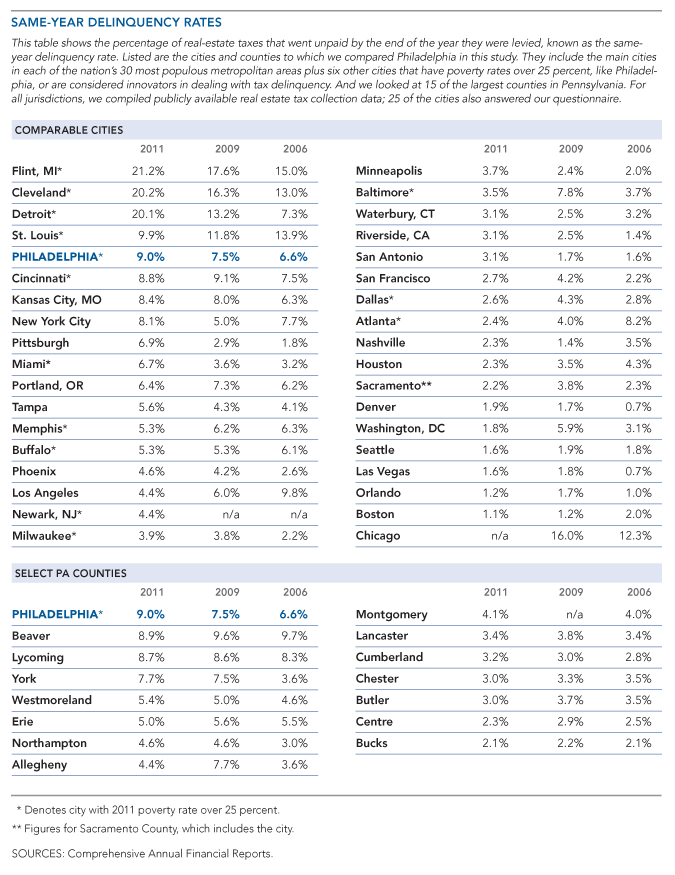

Delinquent Property Tax In Philadelphia Stark Challenges And Realistic Goals The Pew Charitable Trusts

Food And Sales Tax 2020 In California Heather

California S Tax The Rich Folly Orange County Register

Sacramento County Zip Code Map Otto Maps

Sacramento County Transfer Tax Who Pays What

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

Food And Sales Tax 2020 In California Heather

Sacramento County Ca The Bishop Real Estate Group

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

County Cannabis Tax Measure Fails News Galtheraldonline Com

California Property Tax Calculator Smartasset

Local Marijuana Bans In California Keep Illicit Market Alive And Block Revenue Study Shows Marijuana Moment

California Sales Tax Rate Rates Calculator Avalara